The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

Blog Article

The Best Strategy To Use For Mileagewise - Reconstructing Mileage Logs

Table of ContentsHow Mileagewise - Reconstructing Mileage Logs can Save You Time, Stress, and Money.The Buzz on Mileagewise - Reconstructing Mileage LogsAbout Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Fundamentals ExplainedThe Single Strategy To Use For Mileagewise - Reconstructing Mileage LogsThe 3-Minute Rule for Mileagewise - Reconstructing Mileage LogsThe Best Strategy To Use For Mileagewise - Reconstructing Mileage Logs

Timeero's Shortest Distance function suggests the shortest driving path to your workers' location. This function enhances productivity and contributes to cost savings, making it an important asset for services with a mobile labor force. Timeero's Suggested Path function better boosts liability and efficiency. Employees can compare the suggested route with the actual path taken.Such an approach to reporting and compliance streamlines the frequently complicated task of taking care of mileage expenses. There are numerous advantages connected with making use of Timeero to maintain track of mileage.

Little Known Questions About Mileagewise - Reconstructing Mileage Logs.

With these devices in operation, there will be no under-the-radar detours to boost your compensation expenses. Timestamps can be located on each mileage access, increasing trustworthiness. These additional verification measures will certainly keep the internal revenue service from having a reason to object your mileage records. With precise gas mileage tracking technology, your staff members don't have to make rough gas mileage estimates or perhaps bother with gas mileage expenditure tracking.

If a worker drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all cars and truck expenses (mileage log). You will certainly require to proceed tracking gas mileage for work also if you're making use of the real expense technique. Maintaining mileage records is the only means to separate business and personal miles and supply the evidence to the IRS

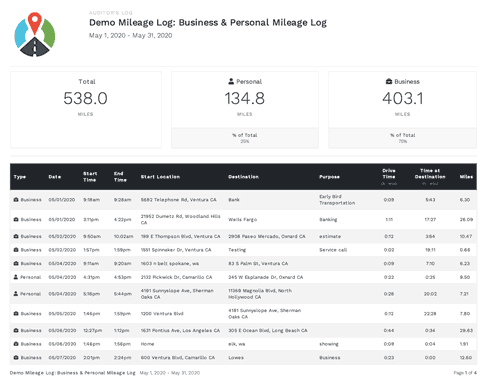

Most gas mileage trackers let you log your journeys by hand while computing the distance and repayment amounts for you. Numerous also come with real-time journey monitoring - you require to begin the application at the start of your trip and quit it when you reach your last destination. These apps log your beginning and end addresses, and time stamps, in addition to the total distance and compensation quantity.

The Main Principles Of Mileagewise - Reconstructing Mileage Logs

This includes expenses such as gas, upkeep, insurance coverage, and the lorry's depreciation. For these expenses to be taken into consideration deductible, the lorry must be utilized for company functions.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

In between, vigilantly track all your business trips keeping in mind down the starting and finishing analyses. For each trip, document the area and service function.

This includes the complete organization mileage and overall gas mileage build-up for the year (organization + personal), trip's day, location, and purpose. It's necessary to tape-record tasks quickly and keep a synchronous driving log detailing date, miles driven, and organization objective. Here's how you can enhance record-keeping for audit objectives: Begin with ensuring a careful gas mileage log for all business-related traveling.

A Biased View of Mileagewise - Reconstructing Mileage Logs

The real costs technique is an alternative to the common mileage rate technique. Rather than computing your reduction based upon an established price per mile, the actual expenditures approach allows you to deduct the actual prices associated with utilizing your vehicle for business functions - mileage log. These costs include gas, maintenance, repair services, insurance policy, devaluation, and various other associated expenditures

Those with substantial vehicle-related costs or special conditions may benefit from the real expenses approach. Please note electing S-corp condition can transform this calculation. Inevitably, your chosen technique needs to straighten with your certain monetary goals and tax situation. The Requirement Mileage Rate is a step provided each year by the internal revenue service to identify the insurance deductible costs of running a vehicle for company.

The Buzz on Mileagewise - Reconstructing Mileage Logs

(https://www.gaiaonline.com/profiles/mi1eagewise/46919649/)Whenever you utilize your automobile for service trips, tape-record the miles traveled. At the end of the year, go to these guys again write the odometer analysis. Compute your complete service miles by using your start and end odometer analyses, and your videotaped business miles. Accurately tracking your exact gas mileage for service trips help in corroborating your tax reduction, specifically if you select the Standard Mileage approach.

Keeping an eye on your mileage by hand can call for persistance, yet bear in mind, it might save you cash on your taxes. Comply with these actions: Document the day of each drive. Tape-record the total gas mileage driven. Think about noting your odometer readings before and after each trip. Write down the beginning and ending points for your trip.

The Single Strategy To Use For Mileagewise - Reconstructing Mileage Logs

In the 1980s, the airline industry became the initial industrial individuals of general practitioner. By the 2000s, the shipping sector had adopted GPS to track bundles. And now almost everyone makes use of general practitioners to obtain about. That suggests almost everybody can be tracked as they go concerning their company. And there's the rub.

Report this page